Summary: Direct Subsidized Loans, also known as Subsidized Stafford Loans, are federal loans provided through the Direct Loans program. These loans are intended for undergraduate students and come with low interest rates and repayment plans that can adjust to your needs. To be eligible, you must demonstrate financial need. A major benefit? The government covers the interest while you’re enrolled at least half-time, during your grace period, and during approved deferment times.

Direct Subsidized Loans (sometimes called Subsidized Stafford Loans) are low-cost, fixed-rate federal student loans available to undergraduate students with demonstrated financial need.

Since the federal government pays the interest while you are in school at least half-time, during the grace period, and during periods of authorized deferment, Direct Subsidized Loans are the least expensive federal student loans available.

- Fixed interest rate of 6.53% for the 2024 - 2025 academic year

- Eligibility is based on demonstrated financial need, as determined by the FAFSA

- The federal government pays the interest when you are in school at least half-time, during the grace period, and during periods of authorized deferment.

- No payments while you are enrolled in school at least half time

- Multiple repayment plans (including income-based) available

How to Apply for a Direct Subsidized Loan (aka Subsidized Stafford Loan)

You need to file the Free Application for Federal Student Aid (FAFSA®) before you can take out federal student loans from the Direct Loans program.

- Complete the FAFSA or Renewal FAFSA (for returning students) at StudentAid.gov.

- Receive a financial aid award letter by mail or email from your school's financial aid office. This letter will summarize your available financial aid, including Direct Subsidized Loans (if eligible).

- Contact your school’s financial aid office to accept the financial aid and including student loans.

- Sign any associated paperwork such as the Master Promissory Note (MPN).

Direct Subsidized Loan Eligibility

Only undergraduate students with demonstrated financial need are eligible to take out Direct Subsidized Loans. Graduate and professional school students are currently ineligible for Direct Subsidized Loans. (Prior to July 1, 2012, graduate-level students were eligible for up to $8,500 a year in Direct Subsidized Loans.)

- Undergraduate student

- Have demonstrated financial need as determined by the FAFSA

- U.S. citizen, national, or eligible non-citizen

- Have received a high school diploma or the equivalent (e.g., GED)

- Enrolled at least half time in an eligible degree or certificate program

- Not in default on any existing federal student loans

- Meet general eligibility requirements for federal student aid

- Credit check

- Cosigner

- Separate loan application

Interest Rates and Fees for Direct Subsidized Loans

The interest rates on Direct Subsidized Loans are fixed and do not change over the life of the loan.

The current fee on Direct Subsidized Loans is 1.057% for loans borrowed through Sept. 30, 2025. Fees are deducted from each loan disbursement. You can ask the college financial aid office to increase the loan amount to cover the fees, up to the annual loan limit.

When Does the Federal Government Pay the Interest On Direct Subsidized Loans?

- While you are enrolled in school at least half-time

- During the 6-month grace period after you leave school

- During periods of authorized deferment

The federal government does not pay the interest during periods of forbearance.

Fill out your loan details to calculate what your monthly payment will be.

$ 0.00 / monthThe following assumptions are made by the calculator: The interest rate remains the same throughout the life of the loan.The calculator does not consider loan fees, deferment, forbearance, or repayment plan which can affect actual payment over time, as well as an extra payment.

This calculator is provided for informational purposes only. Calculated results are based on many factors, including the assumptions provided by the user. We cannot and do not provide any guarantees, conditions, or warranties as to result accuracy or applicability to the user’s particular circumstances. It is the responsibility of the user to verify that all of the output and resulting calculations are correct. This calculator should not be used by anyone to make material financial decisions and should be used solely for informational purposes. Actual terms will be set by your lender or your school. We recommend all borrowers review their federal student loan options first. We encourage any user to seek personalized advice from qualified professionals regarding all personal finance issues.

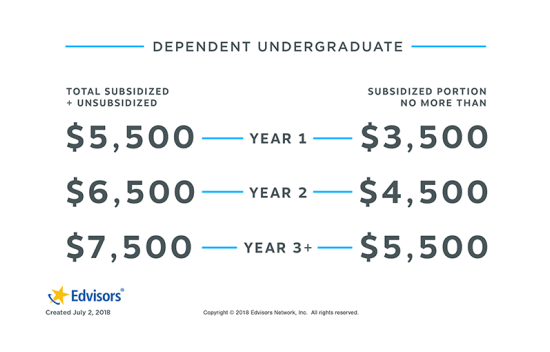

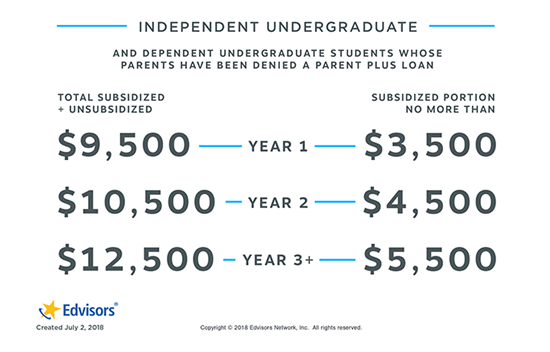

Loan Limits: How Much You Can Borrow

Annual and aggregate (cumulative) loan limits on the Direct Subsidized Loan are the same for dependent and independent students.

Borrowing Limits — Direct Subsidized Loans

Can I get more Direct Subsidized Loan funds?

If you're currently receiving less than the maximum Subsidized Loan award and your financial circumstances have drastically changed since submitting your FAFSA, you might wonder if there's a way to boost that award. The annual and aggregate limits set for Direct Subsidized Loans cannot typically be adjusted, but speaking with your school's financial aid administrator could potentially lead to an increase in your Subsidized Loan award.

How Direct Subsidized Loan Funds are Distributed

If you are a first-time Direct Loans borrower, you will be required to attend entrance counseling before your loan funds are sent (disbursed) to your school. Some schools require in-person counseling, but many offer online counseling. You will learn about the loan terms, conditions, and requirements during the counseling session.

You will also be required to sign a Master Promissory Note (MPN) before the loans can be disbursed.

The Direct Loan program sends the funds to your school to be credited to your student account. In most cases, the loan will be sent (disbursed) in at least two installments.

Special reminder: There is typically a 30-day delay in disbursing student loans to first-time, first-year borrowers.

Loan funds are credited to your account in this order:

- Tuition and fees

- Room and board (if you are living in college-owned student housing)

- Other school charges (with your permission)

If there are any funds remaining in your loan account, you will receive a credit balance refund. This refund can be issued via check, cash, debit card, or electronic funds transfer (EFT) to your bank account. It's important to note that the refund should be utilized for direct and indirect education expenses, like textbooks, supplies, and equipment.

In-School Deferment and Grace Period

While you are enrolled in school at least half-time, your Direct Subsidized Loans will be placed into deferment, which means you don’t have to make any payments. In addition, you don’t have to make payments during the 6-month grace period after you graduate or drop below half-time enrollment status.

The federal government pays the interest on your loans during these periods of authorized deferment.

Direct Loan Repayment

The standard repayment term on Direct Loans is 10 years. However, you can qualify for a longer repayment term if you consolidate the loans or have more than $30,000 in federal student loans.

Direct Subsidized Loans are eligible for all of the different repayment plans offered by the U.S. Department of Education.

Eligible repayment plans:

- Standard Repayment

- Extended Repayment

- Graduated Repayment

- Revised Pay-As-You-Earn (REPAYE) Repayment

- Pay-As-You-Earn (PAYE) Repayment

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

- Income-Sensitive Repayment (ISR)

Recommendations

- File the FAFSA every year to maintain eligibility for student aid.

- Apply for grants and scholarships.

- Borrow Direct Subsidized Loans (if eligible) first. Then, take out Direct Unsubsidized Loans. If you have borrowed the maximum in Direct Loans and still can’t pay all of your costs, consider other funding options like private student loans.